Yesterday, I had the opportunity to step away from my desktop to attend a conference organized by the Florida Alternative Investment Association (FLAIA), a non-profit created to establish Florida as an internationally leading center for Alternative Investment management. As I made my way through the swanky halls of the Hard Rock Hotel, music lyrics reminded me that “money can’t buy me love.” True -- but it can buy entry into the digital economy and further fill my pockets using the innovative investing vehicles.

So let’s forget rock bands for a moment and focus instead on the influential thought leaders who shared their insights at FLAIA’s 2nd annual Artificial Intelligence, Blockchain & Cryptocurrency Forum. They covered the “ABCs” of alternative investment -- sounds elementary but it’s very cutting-edge.

Seeking Alpha with Artificial Intelligence

Asset managers are always looking for an edge, a way to increase alpha and thereby improve client returns. Which is why artificial intelligence and specifically, machine learning, are gaining traction among that crowd. Eagle Investment Solutions’ quant shops in New Jersey and Israel employ six full-time researchers who use machine learning to see hidden relationships in the market. They can take existing strategies and better adapt them to the market because the parameters are not fixed and AI allows for increased automation. In their Quant Macro fund, AI is used to balance allocations in order to improve performance.

Plotinus Asset Management uses AI to progressively learn about the market and respond in real time. They state their “nimble AI” is incredibly fluid and better for risk management. And Bodhi Tree Asset Management currently uses machine learning for anomaly detection with plans for future use as a recommendation engine. All of these asset managers use AI to help drive their investment decisions and continue to improve their active management processes. They are definitely ahead of the pack!

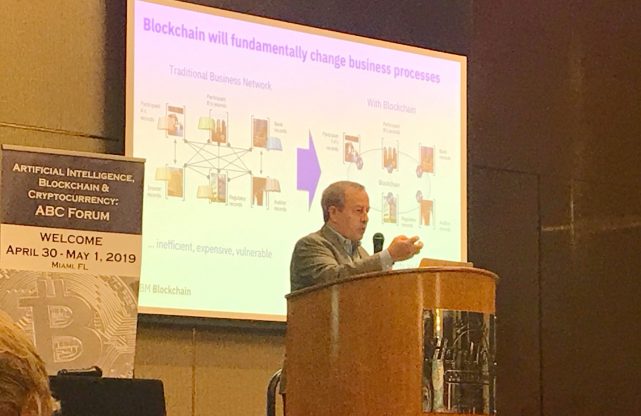

IBM is a Leader in Blockchain for Enterprise

One highlight of the conference was the detailed presentation given by Dave Maddox on IBM’s progress in the blockchain consulting and development space. With over 600 engagements and 100+ networks in play, they have key insights into the current adoption and subsequent evolution of blockchain tech. Projects include the Digital Trade Chain Consortium’s we.trade platform for trade finance, the EverLedger platform for provenance and traceability in the diamond industry, and the TradeLens platform for global supply chain tracking.

“Blockchain will fundamentally change business processes.” In the future, Maddox says blockchains will be interconnected so that provenance chains can communicate with supply chain platforms and then link to payment blockchains. Interconnected, distributed networks will lead to more intelligent technologies that provide us, the customer, with better and faster products and services.

The Changing Climate of Cryptocurrency Capital Raising

The days of capital raising via “white paper” ICOs, projects with no product or revenue that raised millions from unsuspecting and unsavvy investors, has died. Raise your hand if you invested in an ICO! Today, many cryptocurrency investors are looking for cash flow -- just like in any other industry -- when identifying a strong, investible company. According to Jeremy Gardner, Managing Partner at Ausum Ventures and co-founder of open source protocol Augur, projects without cash flow or solid plans to provide healthy revenue streams are unlikely to meet the current buy-side demand.

Thanks to our first panel of the day- Raising Capital in the Current Crypto Environment! Minus one panelist @AlexMascioli - we’ll have to retake this!! #ABCForum2019 pic.twitter.com/NEIdKXtbwt

— FLAIA (@fl_invest) April 30, 2019

The good news is that pension funds and endowments are now investing in alternative investment via the cryptocurrency space. Yale University, for example, has invested in at least two funds dedicated to crypto. Last month, Andreessen Horowitz, a well-regarded VC firm, changed its business model and registered all of its employees as qualified financial advisors. Why? Because registration gives advisors leeway to take riskier bets. According to the company, “If the firm wants to put $1 billion into cryptocurrency or tokens, or buy unlimited shares in public companies or from other investors, it can.”

The Wild West 2017 ICO days are gone, but adoption is on the rise based on how the cryptocurrency investment landscape is changing and maturing. Projects now face more scrutiny but are garnering attention and moolah from more conservative investors like endowments. So while the overall appetite for cryptocurrency projects has decreased, the quality has likely increased, which makes this a great time to stay informed about the market.

At Kambria we made sure to include our revenue generation model in our Master Plan, which includes community services, open innovation as a service, open innovation hubs, technology licensing, and our Kambria store and products. We’re certainly hip to the current capital raising environment.

Bienvenidos a Miami!

By the way, the Hard Rock in Fort Lauderdale, where the event was held, is building a gorgeous new hotel in the shape of an electric guitar. Come and see it for yourself! We’d love to have more ABC supporters here in Florida and welcome you with open arms. Check out Bitcoin Center Miami, an educational center and an official affiliate of Nick Spanos’s Bitcoin Center, while you’re here.

By the way, the Hard Rock in Fort Lauderdale, where the event was held, is building a gorgeous new hotel in the shape of an electric guitar. Come and see it for yourself! We’d love to have more ABC supporters here in Florida and welcome you with open arms. Check out Bitcoin Center Miami, an educational center and an official affiliate of Nick Spanos’s Bitcoin Center, while you’re here.

Laura Guy

Email: info@kambria.io

KAT is a token used on the Kambria platform.